BizChina

- Details

- By Chinaview.cn

- Hits: 1415

PetroChina and PDVSA, the national oil company of Venezuela, have established a joint venture on oil exploration and development, said Jiang Jiemin, Chairman of PetroChina Company Limited here Tuesday.

PetroChina held 40 percent of the new company's shares, Jiang told Xinhua at the annual shareholders meeting.

According to Jiang, a joint venture transporting oil and two joint refineries would also be established. PetroChina would hold 50 percent stake in the former and 60 percent in the latter two.

One of the refineries would be located in eastern Guangzhou Province, Jiang said.

PetroChina is expected to produce 40 million tons of crude oil from Venezuela annually, Jiang said.

He also noted that construction of the China part of the pipeline transmitting crude oil from Russia to China will be started this month and the transmission capacity is expected to expand from the current annual 15 million tons.

Taking advantages of the decreased prices of oil and gas, PetroChina would expand its overseas business, and strengthen cooperation with both energy producers and international energy giants such as ExxonMobile, BP and Shell, Jiang said.

PetroChina is the Hong Kong and Shanghai-listed subsidiary of China National Petroleum Corporation, China's largest oil producer.

- Details

- By Yahoo.com

- Hits: 1254

China's bout of deflation persisted in April, as consumer prices fell 1.5 percent from elevated levels a year earlier, but analysts said they expect prices to start heading upward later in the year.

The central bank, meanwhile, reported Monday that new bank lending in April was less than a third that of the month before, as lenders slowed the flow of credit aimed at stimulating flagging growth.

The consumer price index, which is heavily weighted toward food, fell for the third month in a row after declining 1.2 percent in March and 1.6 percent in February, the National Statistics Bureau reported.

Food prices fell 1.3 percent, with prices for meat falling 13.5 percent, the bureau said in a statement on its Web site.

Prices for pork, China's staple meat, plunged 28.6 percent in April after peaking a year ago following an outbreak of blue ear disease, also known as porcine reproductive and respiratory syndrome, that prompted many farmers to stop raising pigs.

Producer prices, a key indicator of price trends, fell 6.6 percent in April from a year earlier, compared with 6.0 percent in March, thanks largely to lower energy costs.

Overall, costs for fuel and raw materials fell 9.6 percent in April, the report said.

While a protracted bout of deflation would be unwelcome, April's decline was expected, and the data initially helped push share prices higher Monday.

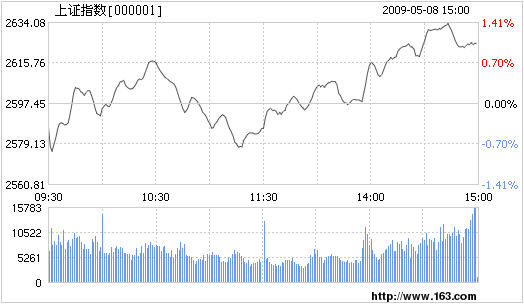

But the benchmark Shanghai Composite Index fell back later in the day as investors sold shares to cash in on recent gains, ending 1.8 percent lower at 2,579.75.

Deflation is expected to persist in China for several more months due to excess inventory in many industries amid the global economic downturn. Sharp declines in crude oil prices and costs for other commodities will ensure that.

But signs of economic recovery in China suggest a reduced risk for a prolonged bout of lower prices that could drag growth lower if consumers put off purchases in expectation of lower prices, forcing companies to cut wages and investment, economists say.

The government has pumped billions of dollars into construction projects and other spending aimed at stimulating demand and propping up growth.

Although growth dipped to 6.1 percent in January-March, its lowest level in at least a decade, improvements in manufacturing, auto sales and real estate data are seen as signs the strategy has begun to work, despite persistently weak demand for Chinese exports in overseas markets.

"Deflationary concerns appear to be subsiding as the economy shows signs of recovery," Jing Ulrich, chairwoman for China equities at J.P.Morgan said in a report to clients.

"Consumer prices should show an uptrend in the second half of the year. Importantly, expectations of rising prices in the future will encourage consumer spending," Ulrich said.

Government moves to liberalize controls on utility rates and fuel prices, which have been kept lower than global levels, will also push prices higher, she said.

"It's too early to say, but we are worried that prices will begin to rebound by midyear, leading to inflation" rather than deflation, said Gao Yi, an analyst at Oriental Securities in Shanghai.

Lenders already have begun to slow the flow of credit to government stimulus projects: the 591.8 billion yuan ($87 billion) in new loans in April was down sharply from 1.9 trillion yuan ($278 billion) the month before, though up 27 percent from a year earlier.

The sharp drop was expected after banks accelerated lending in the first quarter of the year to support a 4 trillion yuan ($586 billion) stimulus package.

The central bank says it will keep monetary policy loose to ensure ample liquidity in coming months. But in its first-quarter report, issued last week, it noted growing concern over the risks of a surge in bad debt and factory overcapacity due to excess lending.

"Commercial banks seem to be caught between a rock and a hard place. The central bank has asked for more lending and also better credit quality," Sherman Chan, an economist for Moody's Economy.com, said in a report issued last week.

- Details

- By David Cao

- Hits: 1462

The global financial crisis is still spreading and the world economy is going to get worse before it gets better, Vice-Premier Wang Qishan said on Friday.

In an article about cooperation between China and Britain in the Financial Times newspaper, Wang wrote that the countries should take stronger measures to stimulate an early recovery of the global economy.

"To overcome the current difficulties, it is essential to convert confidence into credit in the market and quickly recover functions of the financial markets," he said.

China's $586 billion government stimulus package has produced initial results, Wang said, and there has been a "positive change" in the economy. "Things are better than previously expected," he wrote.

- Details

- By David Cao

- Hits: 1718

Chinese equities rose for a seventh consecutive trading day Friday, led by heavyweights.

The benchmark Shanghai Composite Index rose 1.09 percent, or 28.2 points, to close at 2,625.65. The Shenzhen Component Index edged up 0.73 percent, or 74.12 points, to 10,183.06.

Gainers outnumbered losers by 474 to 408 in Shanghai, and 401 to 346 in Shenzhen.

Combined turnover shrank to 244.3 billion yuan (35.77 billion U.S. dollars) from 269.3 billion yuan on the previous trading day.

Oil producers' shares rose Friday on expectations that the government would raise benchmark retail prices for gasoline and diesel.

Read more: Chinese stocks up for 7th day, quake-rebuilding shares gain

- Details

- By Xinhua

- Hits: 1515

Sales of China's domestically made auto set a record high of 1.153 million units in April, up 25 percent from a year earlier, the China Association of Automobile Manufacturers (CAAM) said Friday.

This represents an increase of 3.91 percent from March. In March, sales rose 5 percent year-on-year to 1.11 million units.

Automakers produced 1.157 million motor vehicles last month, up17.9 percent year-on-year, according to CAAM.

More Articles …

Page 115 of 120